Maple Leaf Short Duration Flow-Through offers investors an opportunity to invest in a professionally managed and diversified portfolio of flow-through shares of resource companies. These flow-through shares are issued by companies in the mining and energy sectors and are available to individual and corporate investors by way of Maple Leaf Short Duration Flow-Through Limited Partnerships.

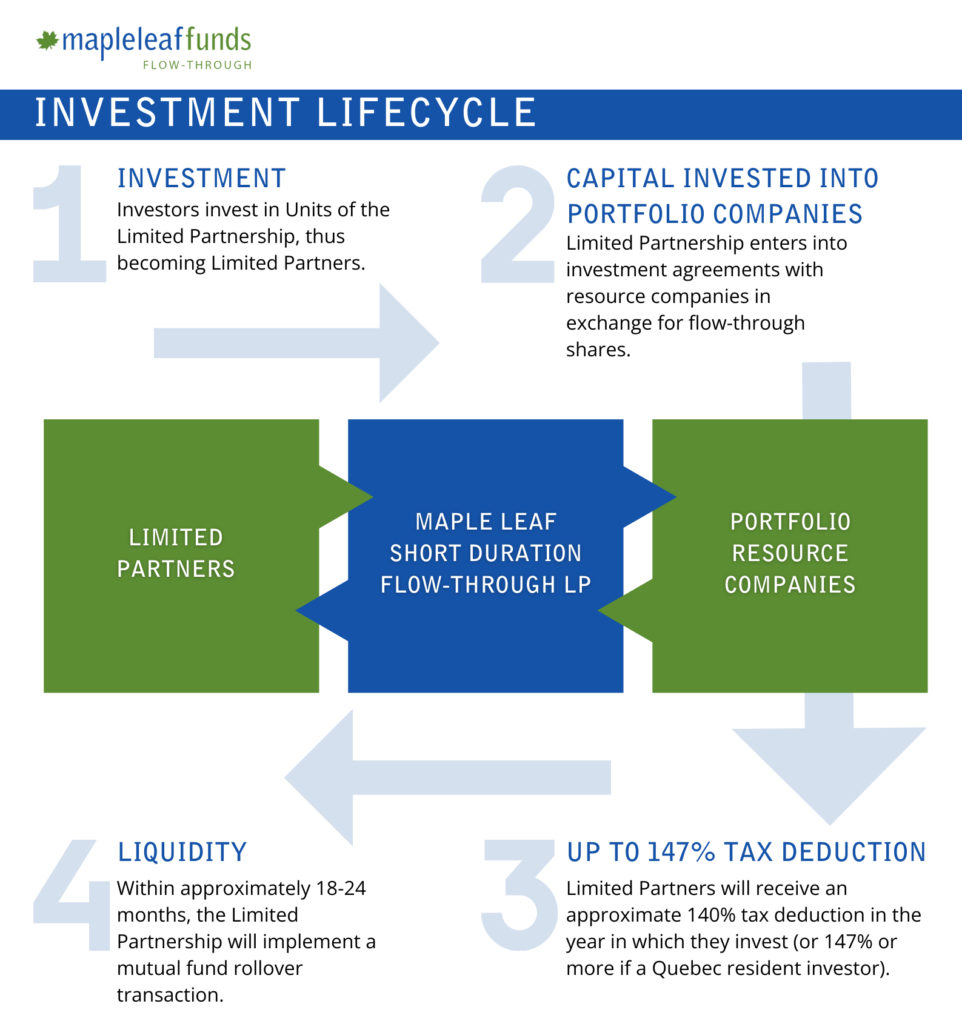

The diagram below illustrates the lifecycle of an investment in the Limited Partnership and the relationship among investors and the resource companies in which the funds invest.

Investors purchase Units in a Maple Leaf Short Duration Flow-Through Limited Partnership, a fund whose mandate is to provide capital appreciation through a diversified portfolio of resource stocks. Investors also benefit by realizing tax savings of up to 147% of the amount invested. The tax savings apply to income from employment, business or property. Through investing in a Flow-Through Limited Partnership, investors can defer the tax payment on the income until some time in the future – when the flow-through shares are liquidated. At this time, the sale proceeds will be taxable in the hands of investors at the more favourable capital gains tax rate.

Others also read . . .

Download Now

Filing taxes for your Maple Leaf Funds investment is made simple with this

easy-to-follow guide.

Investors may deduct issue costs associated with a flow-through limited partnership over a number of years subsequent to the dissolution of the partnership.

View the Issue Cost Deductions in:

All Maple Leaf Short Duration Flow-Through Limited Partnerships roll into Maple Leaf Resource Class Fund Code: CDO100 (the “Mutual Fund”). If you sell shares of the Mutual Fund you will need to know the adjusted cost base (“ACB”) per Mutual Fund share to determine capital gains or losses for tax reporting purposes.