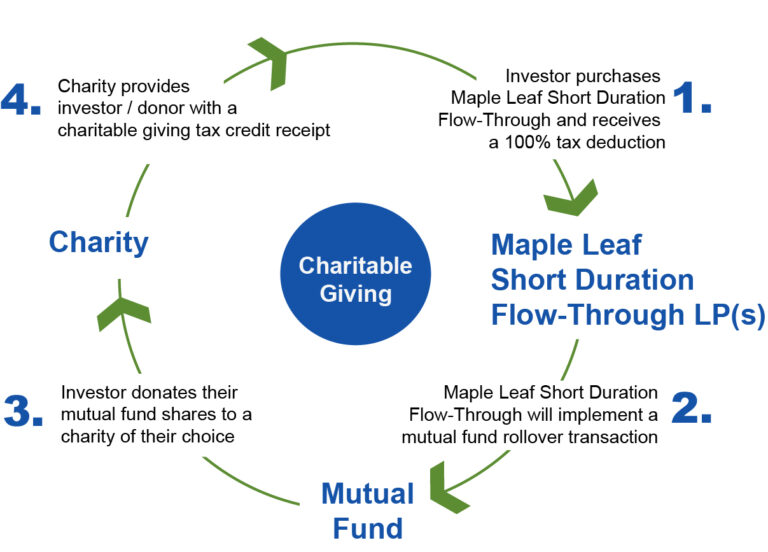

Give to charity by way of flow-through shares & receive additional tax deductions

Charitable giving is a popular way for Canadian investors to donate to the charity of their choice and at the same time receive additional tax savings. Shares of a mutual fund corporation, such as those to be received by investors at the time of the mutual fund rollover transactions qualify for charitable giving.

Charitable donations should be limited to 75% of net income, in any given year. Amounts donated in excess of 75% are not deductible in the year of donation and are carried forward for up to 5 years.

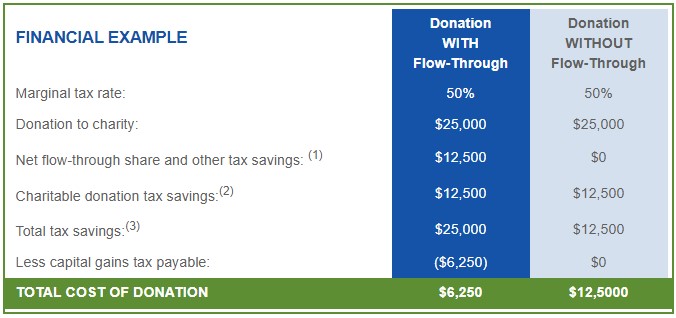

CHARITABLE GIVING INVESTMENT EXAMPLE

- The tax savings are calculated by multiplying the total estimated income tax deductions for each year on assumed marginal tax rate of 50%. This illustration assumes that the subscriber has sufficient income so that the illustrated tax savings are realized in the year shown.

- Assumes charitable donation amount is equal to the original investment amount.

- Estimate for illustrative purposes only.

Others also read . . .

Download Now

Filing taxes for your Maple Leaf Funds investment is made simple with this

easy-to-follow guide.

Investors may deduct issue costs associated with a flow-through limited partnership over a number of years subsequent to the dissolution of the partnership.

View the Issue Cost Deductions in:

All Maple Leaf Short Duration Flow-Through Limited Partnerships roll into Maple Leaf Resource Class Fund Code: CDO100 (the “Mutual Fund”). If you sell shares of the Mutual Fund you will need to know the adjusted cost base (“ACB”) per Mutual Fund share to determine capital gains or losses for tax reporting purposes.